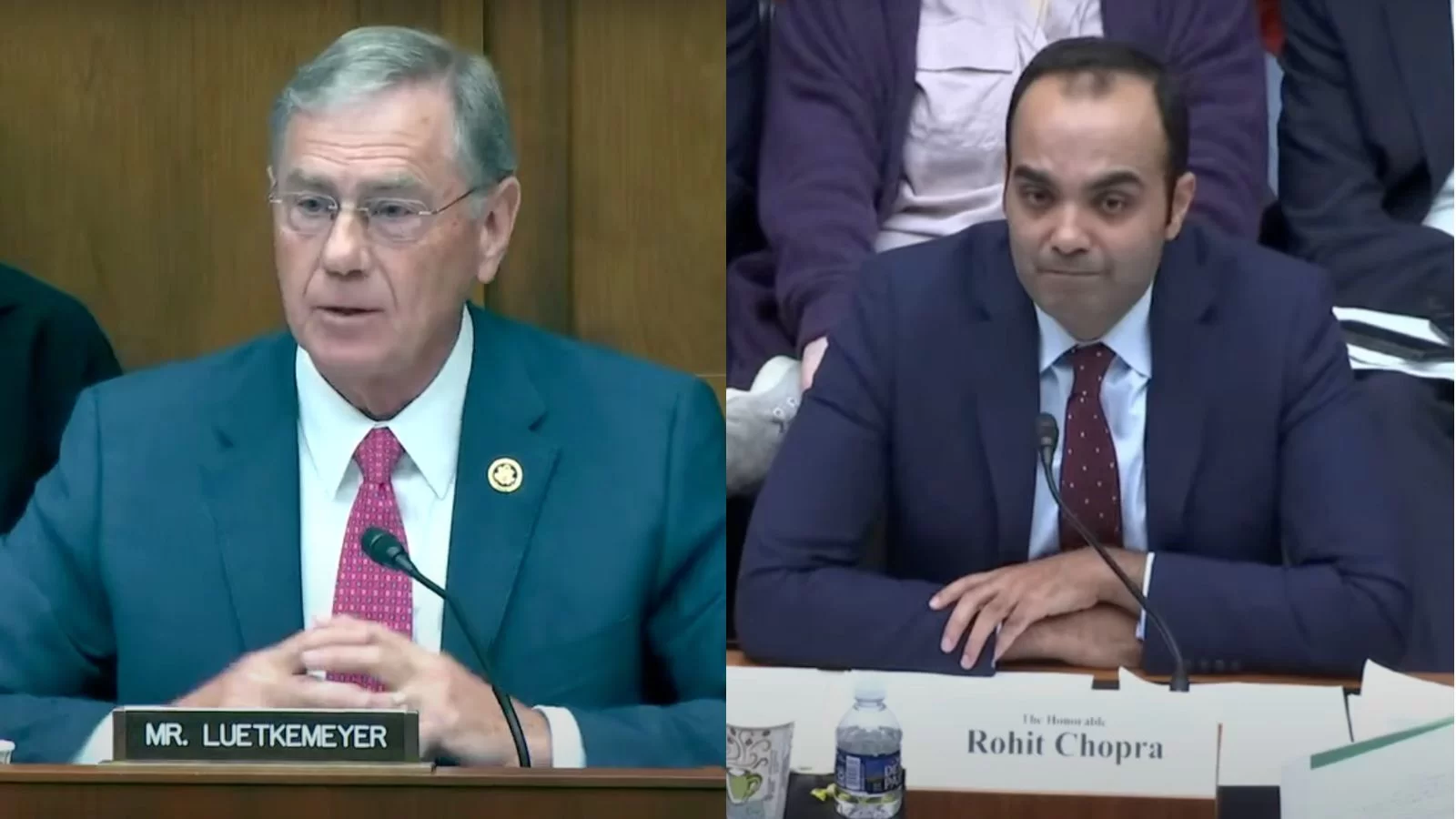

U.S. Rep. Blaine Luetkemeyer (R-MO-3), left, and CFPB Director Rohit Chopra | YouTube

U.S. Rep. Blaine Luetkemeyer (R-MO-3), left, and CFPB Director Rohit Chopra | YouTube

U.S. Rep. Blaine Luetkemeyer (R-MO-3) said the Consumer Financial Protection Bureau’s (CFPB) use of the term "junk fees" is “nonsense.”

His remarks came during a hearing of the House Financial Services Subcommittee on Financial Institutions and Monetary Policy, titled, “Politicized Financial Regulation and its Impact on Consumer Credit and Community Development.”

“Junk fees came from (CFPB) Director Chopra; he doesn’t have authority over certain things so he makes up this word ‘junk fees’ and throws everything in this pile to now have coverage for himself to go out there to use UDAPP to go investigate these things,” said Luetkemeyer. “This word is made up, it doesn’t have any basis in the financial services lexicon and it is not legally enforceable.”

“It is a made up word and now has become a talking point for the other side. This is nonsense,” said Luetkemeyer. “This is how far the CFPB has gone to extend their own authority over things they have no authority to do, and while we’re talking about politicization, this is the paramount example of that.”

UDAAP refers to “Unfair, Deceptive, and Abuse Acts,” under which the CFPB brings enforcement actions. Luetkemeyer is sponsor of a bill, H.R. 6789, the “Rectifying UDAAP Act,” which would require the CFPB to prove intentional misconduct before bringing an enforcement action.

Earlier in the week, the CFPB announced the finalization of a rule it said would cut what CFPB Director Rohit Chopra said were “harvest billions of dollars in junk fees.”

Subcommittee chairman Andy Barr (R-KY-6) opened the hearing by saying that announcing the rule so close to the president’s State of the Union address showed “how politics, not consumer protection, drives the train under Director Chopra.”

“Commenters on the proposal should be appalled that their thoughtful critiques were conveniently tossed aside in favor of political considerations in an election year,” said Barr. “All Americans should be outraged that the cost of credit will skyrocket and access to it will be meaningfully restricted in the name of politics.”

Luetkemeyer, 71, was first elected to Missouri's Third Congressional District in January 2009. He defeated Democrat Eric Mayer by a vote of 63.5% to 32.9%.

A native of Jefferson City, Luetkemeyer graduated from Lincoln University. He previously served in the Missouri House of Representatives, operates a 160-acre-farm and worked in the banking and insurance industries.

Missouri's Third Congressional District encompasses central and eastern Missouri, including parts of St. Charles and Jefferson counties, as well as the state capital, Jefferson City. The district is home to the Lake of the Ozarks.

The CFPB was established in 2011 following the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act. It operates as an agency of the United States government with the primary mission to enforce federal consumer financial laws and protect consumers in the financial sector. The CFPB's jurisdiction encompasses banks, credit unions, securities firms, payday lenders, mortgage-servicing operations, foreclosure relief services, debt collectors, and other financial companies operating in the United States.

Alerts Sign-up

Alerts Sign-up